Advanced Setup for General Ledger (GL) and Transaction Entry in D365 Finance and Operations

Microsoft Dynamics 365 Finance and Operations (D365 F&O) offers powerful tools to manage financial processes efficiently. Understanding advanced setups for General Ledger (GL) and transaction entry is crucial for organizations aiming to streamline financial operations. This guide highlights key configurations and processes to optimize financial management, making it invaluable for professionals pursuing Microsoft Dynamics 365 Training in Hyderabad or looking to advance through a D365 Training program.

Setting Up General Ledger in D365 F&O

The General Ledger is the foundation of financial operations in D365 F&O. Its advanced setup ensures accurate financial reporting and compliance. Below are the key steps:

- Chart of Accounts

- Define the structure of financial accounts.

- Organize accounts into categories such as assets, liabilities, revenue, and expenses.

- Use account structures to define rules for account combinations.

- Fiscal Calendars

- Create fiscal calendars to reflect the organization’s reporting periods.

- Assign these to legal entities and financial dimensions for seamless reporting.

- Financial Dimensions and Dimension Sets

- Use financial dimensions to capture detailed transactional data.

- Configure dimension sets to simplify reporting and analysis.

- Posting Layers

- Utilize posting layers for parallel reporting.

- Separate operational, tax, and simulation layers to meet various accounting needs.

Advanced Transaction Entry

D365 F&O simplifies transaction entry with features that ensure accuracy and efficiency. These steps are essential for advanced users or those enrolled in a Dynamics 365 Course:

- Journal Setup

- Create journal names for specific transaction types, such as general journals, vendor invoices, or accruals.

- Assign approval workflows to control journal postings.

- Default Account Settings

- Define default accounts for transactions to minimize manual entry errors.

- Automate processes like intercompany postings and tax calculations.

- Recurring Journal Entries

- Automate repetitive transactions by setting up recurring journals.

- Customize recurrence patterns for monthly expenses or periodic adjustments.

- Advanced Validation Rules

- Use journal control rules to restrict incorrect combinations of accounts and dimensions.

- Implement approval hierarchies for financial control.

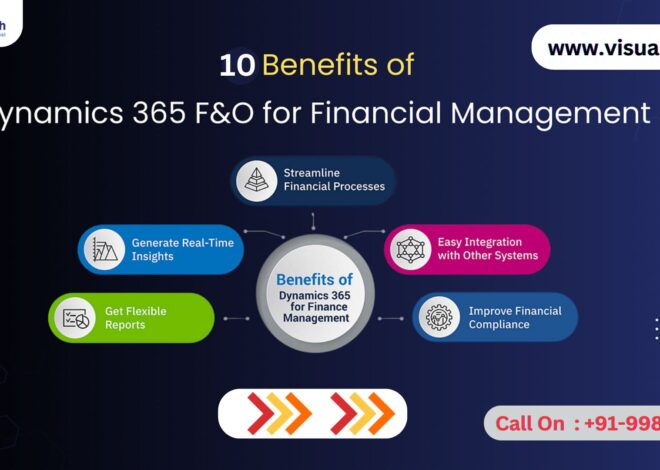

Benefits of Advanced GL Setup

- Enhanced Financial Reporting

- Accurate and real-time insights into organizational finances.

- Regulatory Compliance

- Meets diverse reporting standards across regions.

- Process Automation

- Reduces manual effort and minimizes errors.

Role of Training in Mastering Advanced GL Features

For professionals in finance and operations, advanced GL setup is essential. Opting for Microsoft Dynamics 365 Training in Hyderabad ensures exposure to real-world scenarios. Such training programs focus on hands-on learning, offering insights into advanced tools, configuration, and best practices. A D365 Training program is an excellent way to deepen your knowledge and build expertise in the platform.

By enrolling in a Dynamics 365 Course, learners can stay updated with the latest features and best practices, making them proficient in handling complex financial operations. Advanced GL setup in D365 F&O not only boosts operational efficiency but also enhances your professional skill set in this dynamic field.

Visualpath is the Leading and Best Software Online Training Institute in Hyderabad. Avail complete D365 Functional institute in Hyderabad D365 Training Worldwide. You will get the best course at an affordable cost.

Attend Free Demo

Call on – +91-9989971070

WhatsApp: https://www.whatsapp.com/catalog/919989971070

Visit: https://www.visualpath.in/online-microsoft-dynamics-365-training-in-hyderabad.html