In the complex world of financial management, ensuring accurate and efficient processing of bank transactions is paramount. Microsoft Dynamics 365 (D365) Functional offers a robust solution to this challenge through its Bank Transaction Groups feature.

Understanding Bank Transaction Groups

Bank Transaction Groups in D365 Functional serve as a categorization mechanism for different types of bank transactions. They allow businesses to group similar transactions together, facilitating easier management and improved clarity in financial operations. These groups can include categories such as deposits, withdrawals, bank fees, interest earnings, and transfers, each with a unique identifier and description. D365 Finance Online Training

Setting Up Bank Transaction Groups

Configuring Bank Transaction Groups in D365 Functional involves a straightforward process within the Cash and Bank Management module. Users can define groups by navigating to the setup section, where they assign unique codes and descriptions to each transaction type. For instance, a business might create groups like “DEP” for deposits, “WDR” for withdrawals, “FEE” for bank fees, and “INT” for interest earnings. This setup ensures that each transaction type is easily identifiable and consistently categorized. D365 Finance and Operations Training

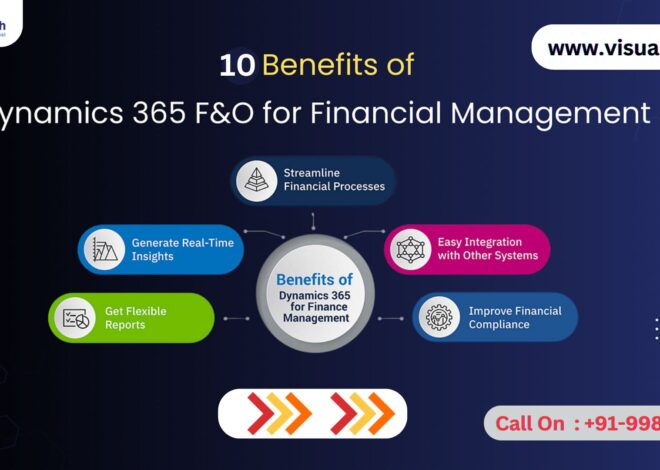

Key Benefits of Bank Transaction Groups

Enhanced Organization: Categorizing transactions into specific groups helps maintain a well-organized ledger. This organization simplifies the tracking and reconciliation of bank activities, reducing the risk of errors. D365 Operations Training

Improved Reporting: Grouping transactions allows businesses to generate more detailed and accurate financial reports. Reports can be tailored to specific transaction types, providing deeper insights into financial operations and performance. D365 Functional Training Hyderabad

Efficient Reconciliation: By segregating transactions into distinct groups, the reconciliation process becomes more straightforward. This separation aids in quickly identifying and resolving discrepancies between bank statements and internal records. Dynamics 365 Finance and Operations Training

Automation and Accuracy: D365 Functional can automate the posting of transactions based on their assigned group. This automation reduces manual entry, minimizes errors, and saves time. For example, all transactions under the “DEP” group can be automatically directed to the appropriate accounts.

Consistent Data Entry: Using predefined groups ensures that all transactions are consistently categorized. This consistency is crucial for maintaining accurate records and adhering to accounting standards.

Visualpath is the Best Software Online Training Institute in Hyderabad. Avail complete D365 Finance Online Training worldwide. You will get the best course at an affordable cost.

Attend Free Demo

Call on – +91-9989971070

WhatsApp: https://www.whatsapp.com/catalog/917032290546/

Visit: https://visualpath.in/dynamics-d365-finance-and-operations-course.html